how much tax is taken out of my paycheck new jersey

1 through the end of 2022. New York will officially suspend its gas tax from Jun.

2021 New Jersey Payroll Tax Rates Abacus Payroll

Several factors - like.

. Total income taxes paid. NJ-WT New Jersey Income Tax Withholding Instructions This Guide Contains. For 2022 the limit for 401 k plans is 20500.

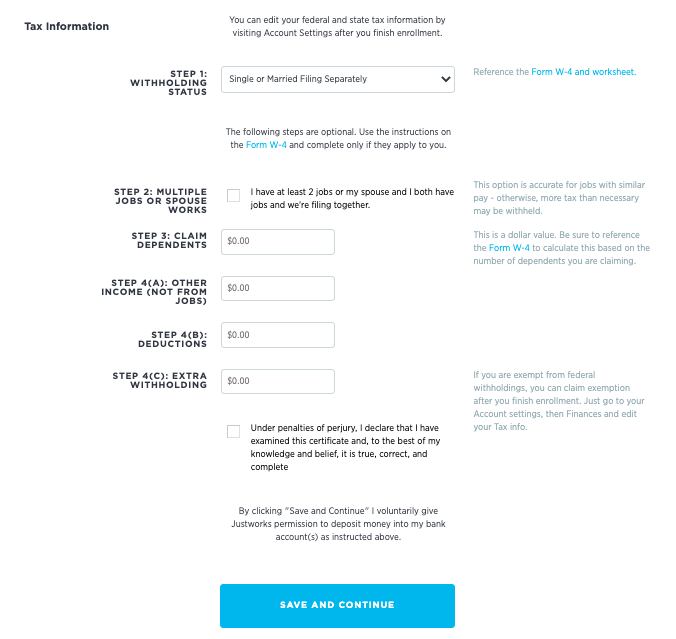

Adjusted gross income - Post-tax deductions Exemptions Taxable income. Mandatory Electronic Filing of 1099s How to Calculate Withhold and Pay New Jersey Income Tax. Its important to note that there are limits to the pre-tax contribution amounts.

Though the credit reduces your New Jersey Income Tax you are not necessarily entitled to a dollar-for-dollar credit for the total amount of taxes paid to the other jurisdiction. Simply enter their federal and state W-4 information. The amount withheld must be at least 10 per month in even dollar amounts no cents.

Calculate your New Jersey. Taxable income Tax rate based on filing status Tax liability. If you own your residence 100 of your paid property tax may be deducted up to 10000.

Federal income taxes are also withheld from each of your paychecks. Free for personal use. Your employer will withhold 145 of your wages for.

Rates range from 05 to 58 on the first 39800 for 2022. This New Jersey bonus pay aggregate calculator uses your last paycheck amount to determine and apply the correct withholding rates to special wage payments such as bonuses. Total annual income -.

For those age 50 or older the limit is 27000. Calculates Federal FICA Medicare and withholding taxes for all 50 states. Well do the math for youall you need to do is.

9am - 1pm CentralPhone. The New Jersey Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and New Jersey. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay.

New Jersey has a progressive income tax policy with rates that go all the way up to 1075 for gross income over 5 million. Only the very last 1475 you earned. Our calculator has been specially developed in.

What percentage is taken out of your paycheck for taxes in new. It is expected to save driers about 16 cents per gallon. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in New Jersey.

Your employer uses the information that you provided on your W-4 form to determine how much to withhold in federal income tax each pay period. Amount taken out of an average biweekly. The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15.

Both employers and employees contribute. As a result of COVID-19 causing people to work from home as a matter of public health safety and welfare the Division will. If you need help deciding whether or.

Amount taken out of an average biweekly paycheck. New Jersey has a progressive income tax system in which the brackets are dependent on a taxpayers filing status and income level. How Your New Jersey Paycheck Works.

It through your MBOS account by completing a New Jersey W-4P. 4 hours agoBut this will change come Wednesday. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in New Jersey.

NJ Income Tax - Withholding Information. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. What percentage is taken out of your paycheck for taxes in new jersey.

If you rent an apartment or a house you can deduct 18 of your yearly rent to cover paid property. If youre a new employer youll pay a flat rate of 28. You are able to use our New Jersey State Tax Calculator to calculate your total tax costs in the tax year 202122.

For a single filer the first 9875 you earn is taxed at 10.

Paycheck Calculator Take Home Pay Calculator

How To Adjust Your Tax Withholding For A Larger Paycheck Mybanktracker

How To Read Your Paycheck Stub Clearpoint Credit Counseling Cccs Credit Counseling Independent Contractor Payroll Template

Here S How Much Money You Take Home From A 75 000 Salary

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

Paycheck Calculator Take Home Pay Calculator

Sample Pay Check And Fica Taxes Savings For Cpt Opt Studetns

2022 Federal State Payroll Tax Rates For Employers

4 608 Paycheck Photos And Premium High Res Pictures Getty Images

Different Types Of Payroll Deductions Gusto

We Make A Personalized High Quality Paycheck Stub W Company Logo For You Including Income Taxes Deductions Ytd Totals Credit Card App Paycheck Income Tax

What Can I Deduct From My Employee S Paycheck Exaktime

How To Calculate New Jersey Income Tax Withholdings

Paycheck Tax Withholding Calculator For W 4 Tax Planning

2020 New Jersey Payroll Tax Rates Abacus Payroll